-

New year good time to review insurance needs

Happy New Year from everyone in the Hermann Sons Life Sales Department. We want every member to know we appreciate their membership and referrals. ...Continue Reading

-

HSL Medicare Agents Ready to Assist Members

Hermann Sons Life is your trusted life insurance and annuity company, but did you know that we offer Medicare too? There are a lot...Continue Reading

-

Whole Life Insurance provides lifetime coverage

When I became a first-time mom at the age of 25, I was told that getting life insurance was the responsible thing to do. I...Continue Reading

-

Navigating Life Insurance Options in Texas with Hermann Sons Life

Life insurance is a crucial element of financial planning, offering peace of mind and security for you and your loved ones. If you reside...Continue Reading

-

How Fixed Rate Annuities Can Secure Your Financial Future

In today’s economic landscape, securing your financial future is more important than ever. One effective way to achieve this is through fixed-rate annuities. Fixed rates provide...Continue Reading

-

Common Misconceptions About Fixed Rate Annuities

As specialist at insurance annuity solutions, Hermann Sons Life understands the misconceptions that often surround fixed rate annuities. These valuable investment tools are sometimes unfairly maligned...Continue Reading

-

The Benefits of Term Life Insurance for Young Families

At Hermann Sons Life, we understand that young families face numerous financial challenges and uncertainties. Among the most critical decisions you can make for your...Continue Reading

-

Maximizing Your Savings with Our Fixed Annuities

One of the most effective ways to ensure a steady and reliable income during retirement is through fixed annuities. Hermann Sons Life offers a range of...Continue Reading

-

Top 5 Reasons Texans Need Life Insurance Now More Than Ever

Life insurance is more critical today than ever before, especially for Texans navigating an unpredictable world. As families face financial challenges and uncertainties, ensuring...Continue Reading

-

When is the Right Time to Buy an Annuity?

Fixed annuities are a popular choice for individuals seeking stable and reliable income during retirement. Unlike variable annuities whose returns fluctuate based on market...Continue Reading

-

Understanding the Value of Our Senior Adult Final Expense Plan

For many individuals, discussing final expenses can be uncomfortable, but it’s an important aspect of financial planning, especially for those aged 50 and older....Continue Reading

-

Secure Your Retirement with Hermann Sons Life Fixed Rate Annuities

Planning for retirement can be a daunting task, filled with uncertainty and complex financial decisions. However, with the right retirement asset, you can navigate...Continue Reading

-

Choosing The Right Texas Life Insurance Policy

Life is full of uncertainties, but your financial future doesn’t have to be. When it comes to safeguarding your loved ones and securing your...Continue Reading

-

‘Grow with Us’ new 2024 campaign

Happy New Year! Thank you for all you do for your lodge. I appreciate every member who attends their lodge meetings and especially those...Continue Reading

-

Give the gift of financial protection

The Hermann Sons Life Sales Department wants to wish you and your family a Merry Christmas and Happy New Year! As you are shopping...Continue Reading

-

New Greater Texas Lodge will be virtual

To grow membership throughout all of Texas and to provide a wider outreach of community service, Hermann Sons Life has created the first virtual...Continue Reading

-

German immigrants pave way for Hermann Sons Life

October not only brings with it cooler temperatures and fall colors, but this month also comes alive with vibrant colors, sounds and flavors of...Continue Reading

-

Members compete in bowling tourney

For Hermann Sons Life Statewide Bowling Tournament final (official) results and payouts, click HERE. The words thank you are said over and over, but I have to...Continue Reading

-

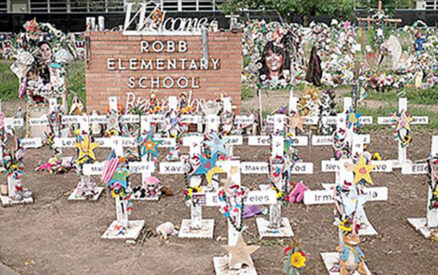

Grief Support Camp held for Uvalde children

After the tragedy in Uvalde, I had members and lodges asking me, “What are we going to do for Uvalde?” I wanted to do...Continue Reading

-

Annuity rates increase

Hermann Sons Life has raised annuity interest rates for the Flexible Premium Deferred Annuity product to 4 percent. Your Home Office staff is working...Continue Reading

Our Agents Are Ready to Help!